What is an Annuity?

An annuity is a long-term, tax-deferred insurance contract or investment designed for retirement. This means you don’t start paying taxes on any earnings until you start receiving payouts.

It allows you to create a fixed or variable stream of income during your retirement through a process called annuitization.

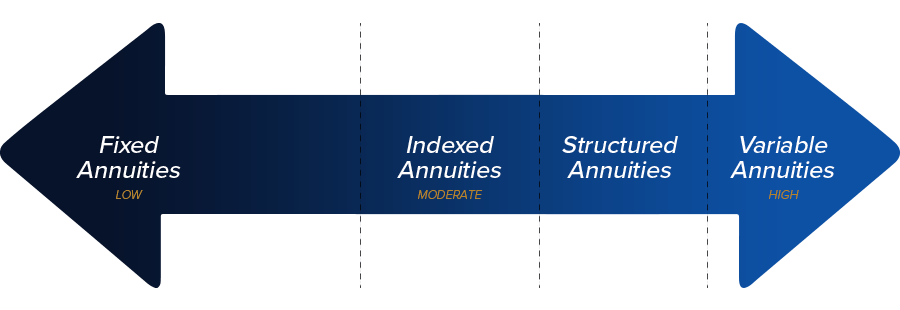

Types of Annuities:

There are many different annuities to choose from. It’s important to choose an option that’s suited to your current financial situation and your long-term financial goals. Make sure to compare annuities to find what will work best for you. We have a team of qualified experts that can help guide you in the right direction.

Fixed Annuity

A fixed annuity is an insurance contract that guarantees the buyer a fixed interest rate on their contributions for a specific period of time. Fixed annuities are good investments for those interested in premium protection, income for life and low risk. A fixed annuity also does not offer any inflation protection, which may be considered a disadvantage to some.

Variable Annuity

A variable annuity is a type of annuity whose value is tied to the performance of an investment portfolio. Payments from variable annuities can increase if the portfolio performs well and decrease if it loses money. Although variable annuities carry the potential of higher returns than fixed annuities, they don’t offer a guaranteed payout.

Indexed Annuity

An indexed annuity, also known as a fixed-index or equity-indexed annuity, features income payments tied to a stock index, such as the S&P 500. Indexed annuities perform well when the financial markets perform well. People often refer to indexed annuities as hybrids of fixed and variable annuities.

Risk Scale By Type:

Frequently Asked Questions:

When is the best time to buy an annuity?

Because of the tax-deferred compound interest that builds over time, there is a chance it’ll cost you if you wait to purchase an annuity. Ultimately, the time is now! The earlier you purchase an annuity, the more opportunity for your money to grow.

What is the reasoning behind buying an annuity?

If you want a guaranteed lifetime income stream, an annuity is a popular option. If there’s a chance you’ll outlive your savings in retirement, an annuity solves that issue plus it provides tax benefits in the meantime.

What type of annuity should I buy?

Everyone is different and has different circumstances in their lifetime. There are different risk tolerances, financial goals and timelines for everyone. It’s important to talk to an Annuity professional to help solve this question.

Takeaways:

- There are different risks and payout options for each type of annuity. The best annuity for you will depend on your personal goals and objectives.

- It’s your decision to defer your payment to a specific date or start receiving them immediately.

Fill out the information below to receive FREE QUOTE from an experienced Annuity expert today or give us a call today: 800-365-8208