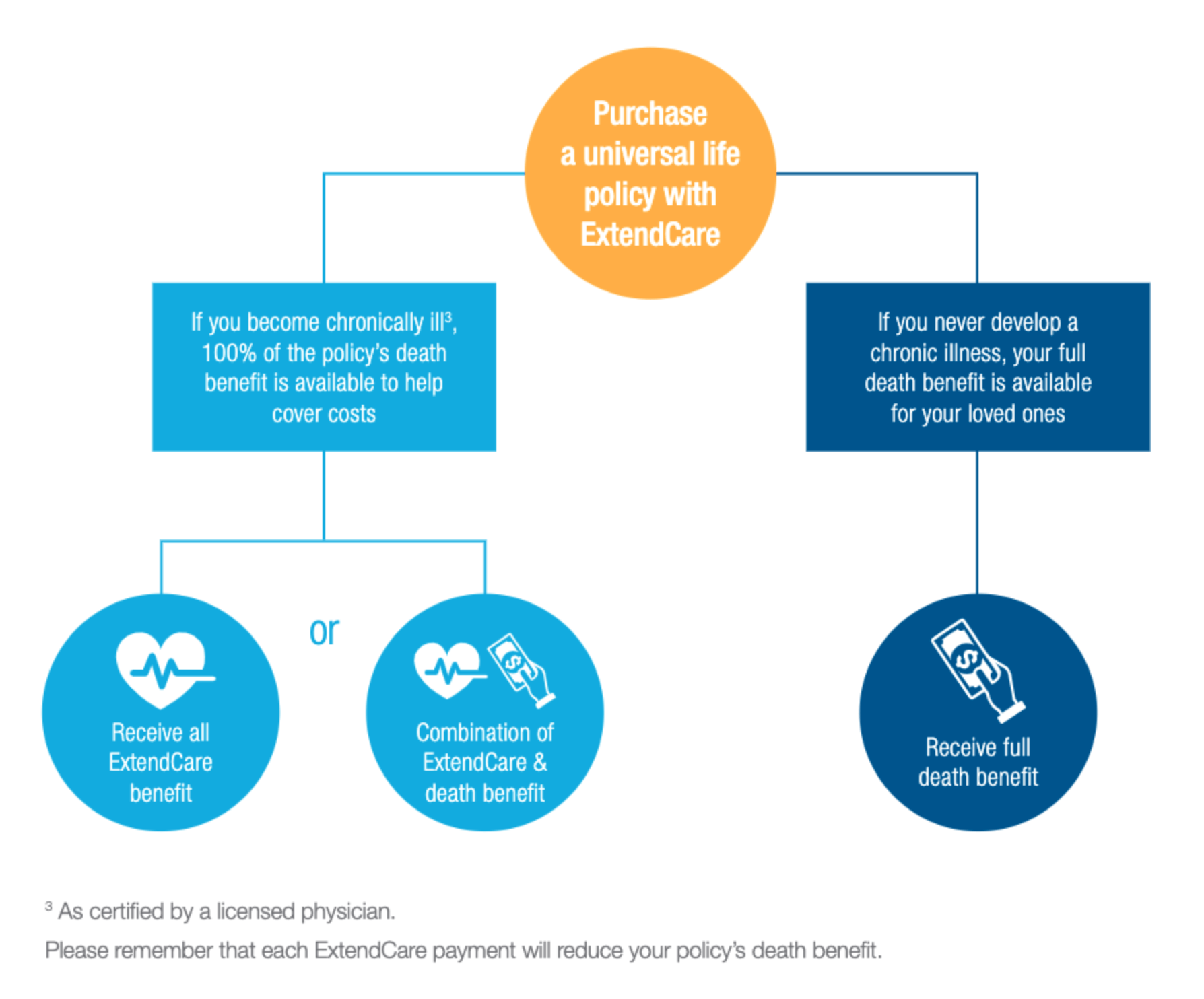

Indexed Choice Universal Life is the answer. This truly is one great packaged plan!

Why take Risk: the odds of developing a chronic illness are daunting and the impact is overwhelming.

The Facts:

- ½ of people turning 65 will need some type of long-term care service in their lifetime.

- The average cost of nursing home private cost today is $102,200 (cost of care, longtermcare.gov)

- This is also a serious toll on your loved ones.

- ExtendCare can be used for home health care, nursing home, assisted living, professional Nursing care, hospice, and more.

Sales Options for Younger Clients:

1: Death Benefit; 2: income when needed; 3: Chronic Care.

Fill out the information below to automatically Download the Protective ExtendCare Brochure or call a Senior Health Specialists at Premier Marketing:

800-365-8208