Complete and submit this form to get your business to the place only Premier is uniquely qualified to take you.

This policy has exclusions, limitations and reductions and terms under which the policy may be continued in force or discontinued. Benefits may be provided by a combination of the policy and riders and are subject to underwriting. Premiums will vary depending on the benefits selected. Premium rates may increase. A medical exam may be required for coverage. For costs and complete details of coverage, call your agent/producer or write to the company. The insurance provided will be individual coverage, not group coverage. Long-term care insurance is not a deposit, not FDIC insured, not insured by any federal government agency, not guaranteed by the bank, not a condition of any banking activity, may lose value and the bank may not condition an extension of credit on either: 1) The consumer’s purchase of an insurance product or annuity from the bank or any of its affiliates; or 2) The consumer’s agreement not to obtain, or a prohibition on the consumer from obtaining, an insurance product or annuity from an unaffiliated entity. This is a solicitation of insurance. An insurance agent/producer may contact you by telephone to provide additional information

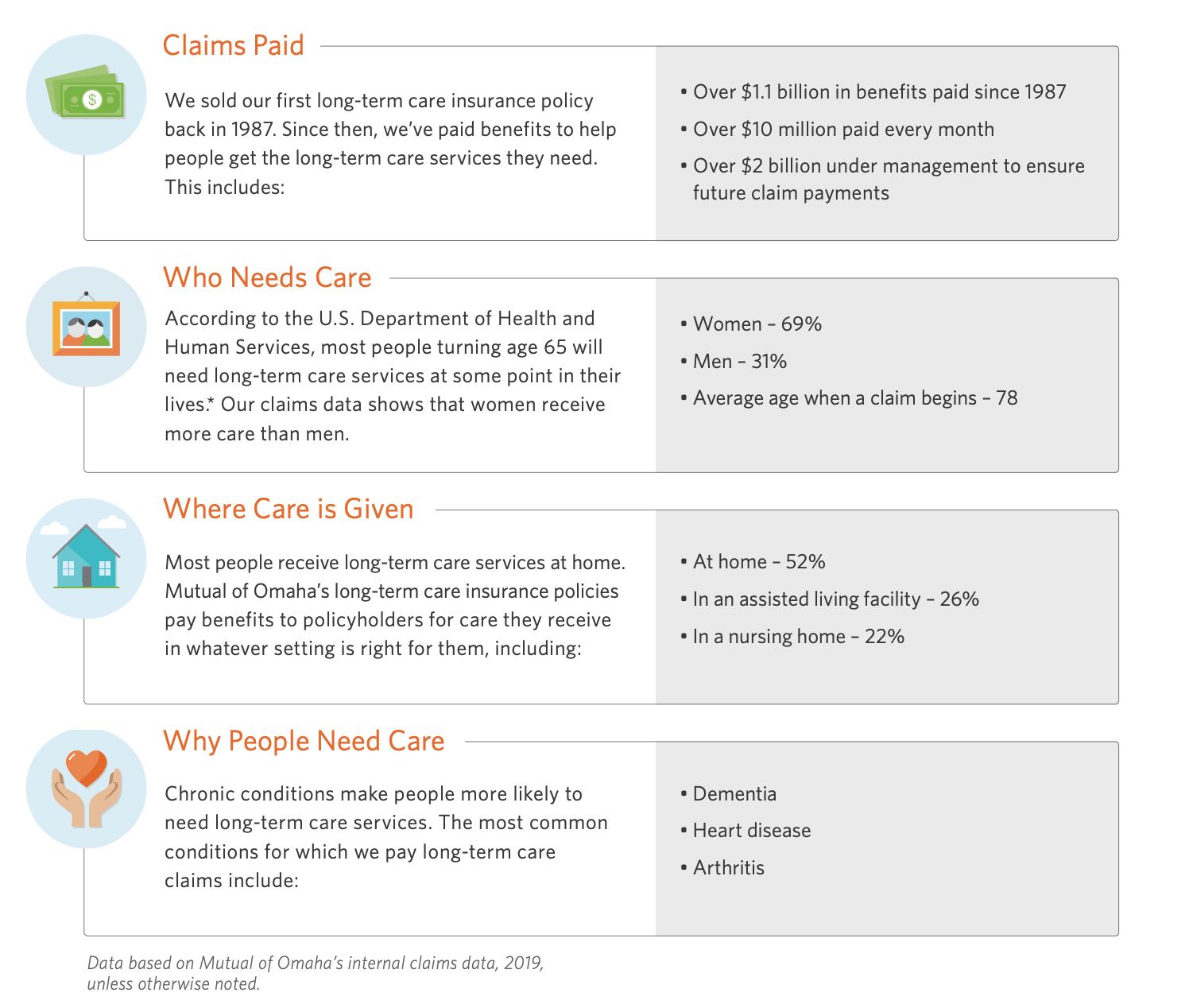

“Mutual of Omaha’s LTC Claims Discussion and Experiences”

Wednesday, June 29th @ 1:00 PM CDT