Sales Idea:

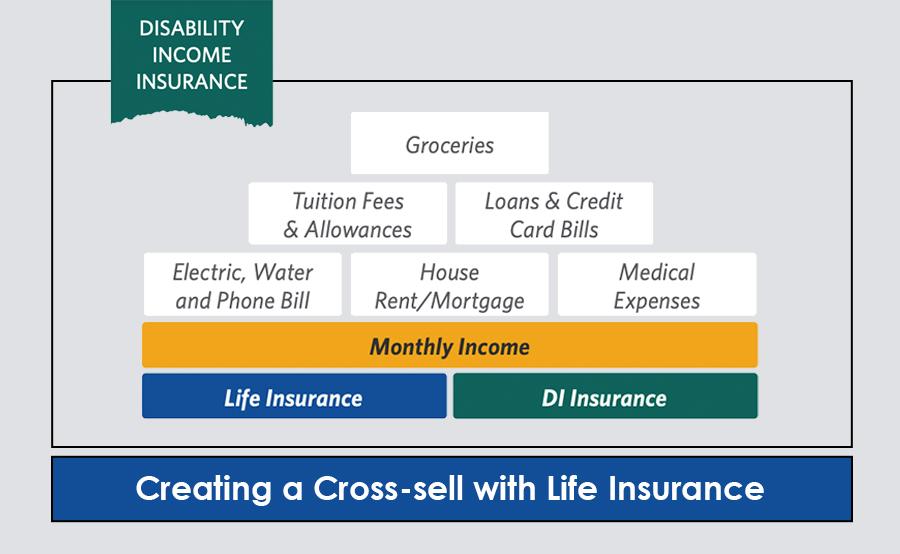

If a client is only planning for when they’re no longer here, they’re leaving themselves and their family unprepared for the present.

Solution:

Life insurance is a large piece of a client’s income protection strategy – but it’s not the only piece. If your client were to become sick or injured and was unable to work, it’s likely their life insurance policy would provide little to no help in securing their financial stability. A disability income protection policy can work alongside life insurance to provide financial protection clients can use today.

Market to Target

- Income ranges $50,000 to $300,000

- Families with children or individuals with lifestyles/livelihoods to protect

- New and existing homeowners

- Recently married couples

- New and expectant parents

DI: What Your Clients Need to Know

- Mutual Income Solutions has monthly benefit amount options from $300 to $20,000

- Over 10 optional benefits to customize coverage

- Multi-policy discount if you’re issued an individual disability policy within 90 days of being issued an eligible fully underwritten life insurance policy

- Benefits can help replace a portion of your income if you’re sick or injured so you can continue to cover costs including:

→ Mortgage, utilities and groceries

→ Car payment and insurance

→ Childcare expenses

→ Life insurance premiums

→ Increased medical expenses

Get Started Today.

Fill out the information below to automatically download the handy informational flyer or call Kati at Premier Marketing: 800-365-8208