Webinar Calendar and Recordings

Did you look into the webinars we're hosting this week? Did you miss a webinar? You can find the list of upcoming webinars and the recordings to all past webinars by clicking below. View our Upcoming WebinarsCheck out Past Webinar RecordingsWebCE®

WebCE® is the leading insurance continuing education provider in North America, delivering over 750,000 insurance CE courses. Our nationwide online insurance continuing education catalog includes the largest selection of state-specific self-study insurance CE courses, including NAIC annuity training, long-term care insurance CE, flood insurance CE and training, ethics, law, and many more. Multi-course online insurance CE bundles start at just $12.95.

Exam FX

We offer a complete program of online training for insurance licensing and securities exams, designed to ensure you pass on first attempt. We understand the challenges you face when taking on a new career or taking the steps to further your career to the next level, and we are here to empower you to achieve your professional goals.

Medicare Programs

A burgeoning market in the Insurance world, over ten thousand people a day from the Baby Boomer era are aging into Medicare. A substantial number of disabled are also eligible for Medicare, with over 59 million people having Parts A and/or B of Medicare, according to CMS Fast Facts.

Resources devoted to assisting agents to compliantly market this population include:

General Information and Program Remedials

Market Niches and Program Specifics

Carrier Information and Product Detail

Premier Marketing’s strong relationships with carriers across the country also allows the leveraging of their resources, including specific company product and marketing assistance programs. With the addition of Premier Marketing directed trainings, agents have access to some of the top resources available in the industry.

Ancillary Products

Despite the best intentions of Insurance Companies, Marketing Organizations, and Agents alike, most basic insurance programs leave a need for additional coverage in some circumstances. Premier Marketing addresses this need by partnering with companies that offer programs that add coverage for those in need. Those programs include, but not limited to:

Premier Marketing’s strong relationships with carriers across the country also allows the leveraging of their resources, including specific company product and marketing assistance programs. With the addition of Premier Marketing directed trainings, agents have access to some of the top resources available in the industry.

Dental, Vision & Hearing

Hospital Indemnity

Hospital indemnity insurance pays a set amount for each day that an enrollee is hospitalized, without regard to the hospital expenses incurred. This supplemental insurance policy may also include payments per ambulance trip, surgery visit, or even increased payments for more critical ailments such as cancer or stroke.

Cancer/Critical Illness

In order to manage the risks associated with cancer and its many forms, we offer a variety of cancer insurance policies. These supplemental health insurance plans are designed to fill in any gaps left by conventional insurance policies, but may not provide coverage for the full range of health issues related to the disease.

Life Products

The tools below will provide you with the knowledge and resources to help you grow your life insurance production.

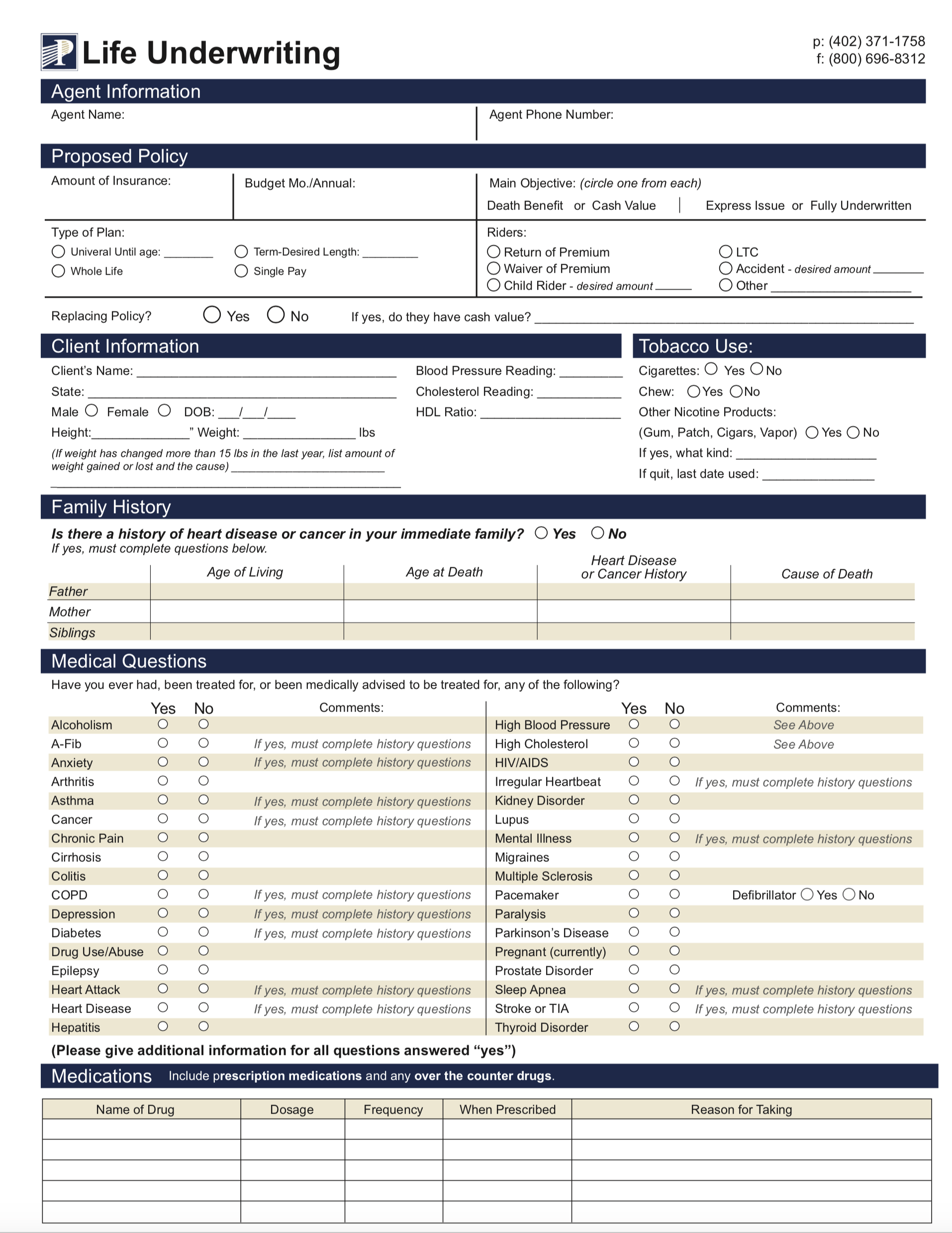

HOW TO FILL OUT AN APP

ATTEMPTS TO DEFRAUD

MISSING INFORMATION

There are many times we receive incomplete applications. It could be just a few questions were missed to a whole section that was totally overlooked. The best way to overcome these errors is to take a three step approach to completing the application.

| Step 1 | Step 2 | Step 3 |

| Review the entire application prior to meeting with the client. Cross through any sections of the application which do not apply to your client. Example: If there is not a plan to insure an “other insured”, then cross through that section since it doesn’t need to be completed. Use “Sign Here” stickers in places where the applicant and/or owner must sign. This will save you valuable time when you’re in front of your client. | When you are with your client, assume nothing. Ask every question on the application as if this is the first meeting with the client. Reconfirming small details such as the spelling of names and the mailing address. This will save countless hours in processing the application. Explain this to the applicant that accuracy is key in making the process as smooth as possible so you will reconfirm all information placed on the application even if it is being redundant. | Prior to submitting the application to Premier Companies, review the application in its entirety again. If you’re missing any information or signatures, secure those prior to submission. A fully completed, 100% accurate application with a cover letter is critical to a streamlined process. |

LEGAL RESPONSIBILITY OF THE AGENT

In conclusion, you need to paint a picture for the underwriter. If properly written, the application and all of the other information will back up your cover letter. It’s helpful to include the contact information not just for yourself, but any other professional such as the client’s attorney, CPA or business partners. A proactive approach is the best way to help your clients obtain positive results and more policies being issued at the desired ratings.

How to Effectively Write a

Life Insurance Underwriting Cover Letter:

General Information and Program Remedials

Obtain a better rate class

Get paid more efficiently by having less declines or highly rated cases.

Seven Parts To Writing a Successful Cover Letter:

1. Introduction

2. Identify the Client

3. Justify the Insurance

4. List in Force Insurance/Replacement

5. Medical Assessment and Family History

6. Current Medication

7. Owner and Beneficiaries

Final Expense

We truly believe that we have the life insurance industry’s most robust and unique sales and marketing system – Legacy Safeguard. With Legacy Safeguard, you can help your clients leave a lasting legacy and be remembered long after they’re gone with a free membership in Legacy Safeguard.

Legacy Safeguard provides members with legacy planning and end-of-life planning assistance, support and guidance. Members receive the following benefits when they enroll into Legacy Safeguard:

Legacy Planning Services

End-of-Life Planning, Guidance & Assistance

Estate Planning Support

Support for Survivors

Celebrating Life Events

Legacy Safeguard offers value to everyone. Clients receive comprehensive legacy planning and end-of-life planning service to help them leave a lasting legacy and be remembered long after they’re gone. Agents and agencies get access to the turn-key sales and marketing system that is proven to increase sales, persistency and face amounts. Legacy Safeguard is a marketing system you can use today without re-inventing the wheel. Legacy Safeguard provides members with legacy planning and end of life planning guidance, assistance, and support while adding an additional service you can have in the home.

The Postseason Game Plan is a guide that helps you successfully advance through the Medicare season and into the Postseason to become a Senior Market Champion.

The Postseason Game Plan shows you how to provide the game changing Legacy Safeguard service and thank your clients for working with you on their Medicare planning needs.

Whatever you do, don’t over extend your “bye week” and let too much time go by once the Regular Season is over. Take advantage of your hot streak, and get started with the Postseason Game Plan so you can help more clients than you ever thought possible by using our valuable system.

There is not another marketing plan as easy to implement in the Senior Market as the Postseason Game Plan and by offering Legacy Safeguard you will be able to make more presentations and close more sales.

Annuities

Closing annuities has to do with confidence,

education and help.

Gain Access to the Annuity Resource Center by Logging onto the Premier Agent Portal or reach out to your marketer today.

Long Term/Short Term Care

If you are looking to learn about long term care or just brush up on your skills, the following offers a number of training capabilities and resources to help you learn more about long term care. Click on the link to see what would work best with your busy schedule.

CLTC program

The “Certified in Long-Term Care” (CLTC) program is the long-term care insurance industry’s only independent professional designation. Created in 1999, the course is focused on the field of long-term care planning and provides legal, accounting, insurance and financial service professionals the critical tools necessary to address the subject matter with their middle-age clients. All of the LTC marketers at Premier’s LTC Brokerage hold the CLTC designation.