Traditional Life

Industry Resources

A young mother made sure her family’s future was protected with life insurance.

Life Insurance 101

No one really wants to think about life insurance. If someone depends on you financially, it’s a topic you can’t avoid. Getting life insurance doesn’t have to be hard (or boring). We have some answers to common questions about life insurance so you can make informed decisions about protecting your loved ones financially.

Life Happens’ mission, as a nonprofit, is to give you unbiased information to help you make smart insurance choices to protect your loved ones.

Why is life insurance worth it?

Life insurance is important because it’s a simple answer to a very difficult question: How will my loved ones manage financially if something were to happen to me?

What are the different types of life insurance?

Life insurance generally falls into two categories:

Term life insurance provides protection for a specific period of time (the term), often 10, 20 or 30 years.

Permanent life insurance provides lifelong protection, as long as you pay the premiums.

Learn more about how life insurance can help your loved ones

What is the avarage life insurance cost?

Do I need life insurance?

That’s a great question. And the truth is not everyone does. But ask yourself, “Would someone suffer financially if I died?” If you answered, “Yes,” then chances are you need life insurance.

Life Insurance Needs Calculator

Answer a few simple questions to estimate the amount of life insurance coverage you need to take care of your family.

This is an estimate only. For a complete assessment, contact a qualified insurance professional.

Short-Term Solutions

Our short-term solutions portfolio offers clients the choice of two easy-to-understand products with coverage that doesn’t break the bank.

Permanent Solutions

Premium flexibility, potential cash-value growth, options to customize coverage—these are just some of the features you’ll find in Protective’s diverse product portfolio.

Unique Concepts & Features

Life insurance isn’t one size fits all. That’s why Protective offers unique features and strategies that can help meet client needs.

Marketing Toolkit

Products

Explore product specs, key marketing materials, and more.

Sales Concepts

Help identify and meet your

client’s needs.

Web Events

Live and recorded events about North American’s products, technology, and sales concepts.

Technology

Information about online e-app, accelerated underwriting, and more.

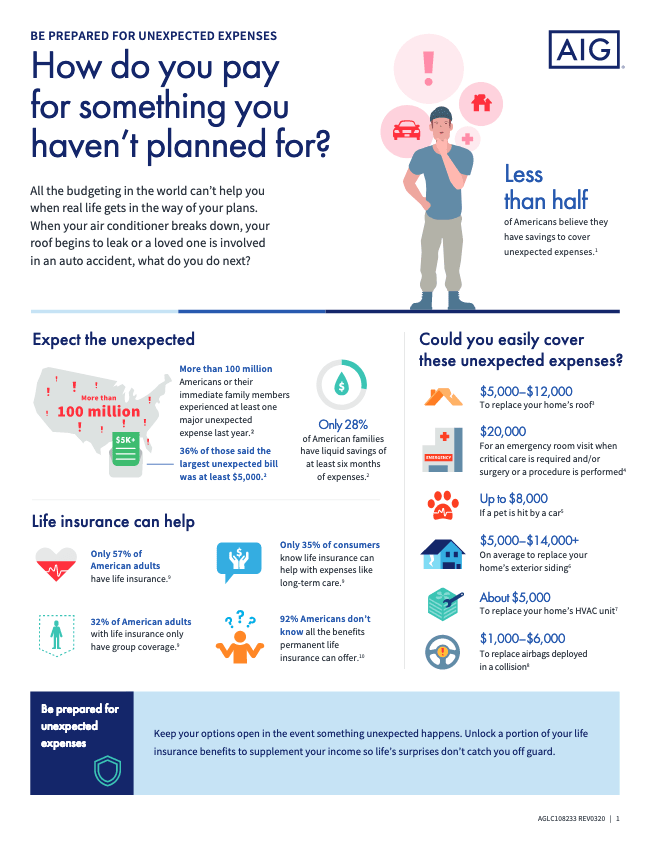

Powerful videos and compelling statistics can tell an impressive story – start meaningful conversations with these tools.

Choose from our library of videos and infographics. Copy, Paste, GO!

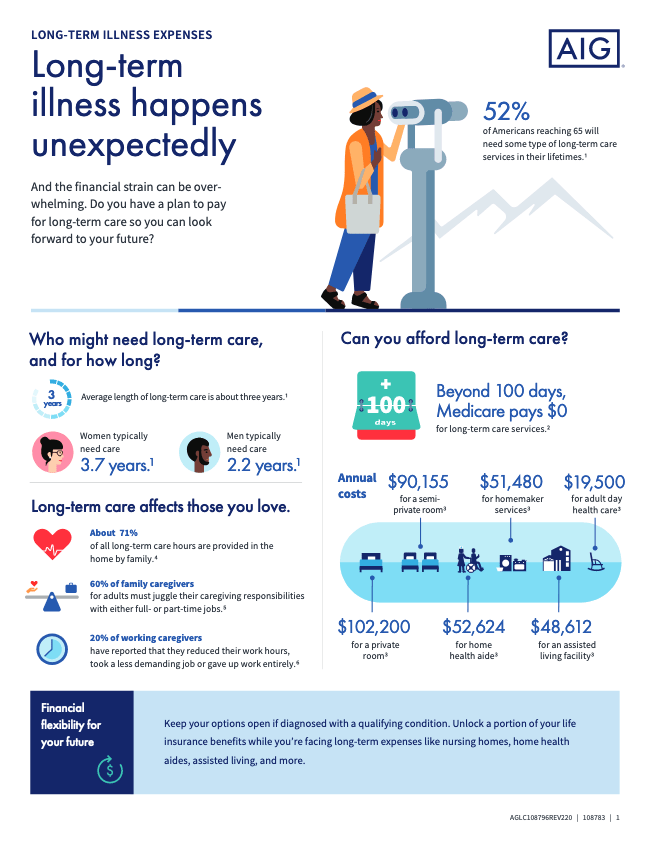

Living Benefits

Living benefit riders offer financial protection you need in the event of a qualifying condition. This income tax–advantaged benefit lets you access funds from your life insurance policy while you are living

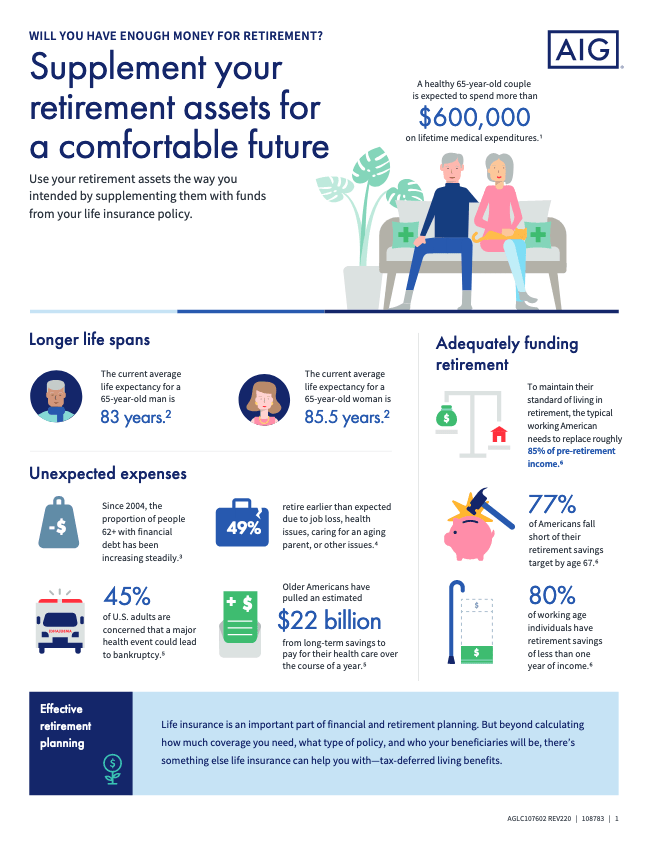

Retirement Plan

Who We Are

Membership

Industry News

Advocacy

Events

NAILBA is essential to the future success of America’s insurance and financial services wholesale brokerage distribution.

Membership Benefits:

Belong, Connect & Grow!

How Do I Use

NAILBA University?

LIMRA brings the financial services industry together. They are a worldwide research, consulting and professional development organization that connects people to data, thought leadership, solutions, and each other.

Life Insurance Research

Find the insights and benchmarks you need to make strategic decisions and grow sales. You will find actionable information on these and more.

Featured Life Insurance Research

We've increased exam-free eligibility from $1M to $2M

Using our digital application with its ultra-fast decisions, reduced cycle times, and greater flexibility will make life easier for you and your clients. We’re excited to be expanding the ability for your clients to have more APS/exam-free approvals.

- Ages 20-50, up to $2 million, any term duration

- Standard Plus, including Preferred Tobacco or better