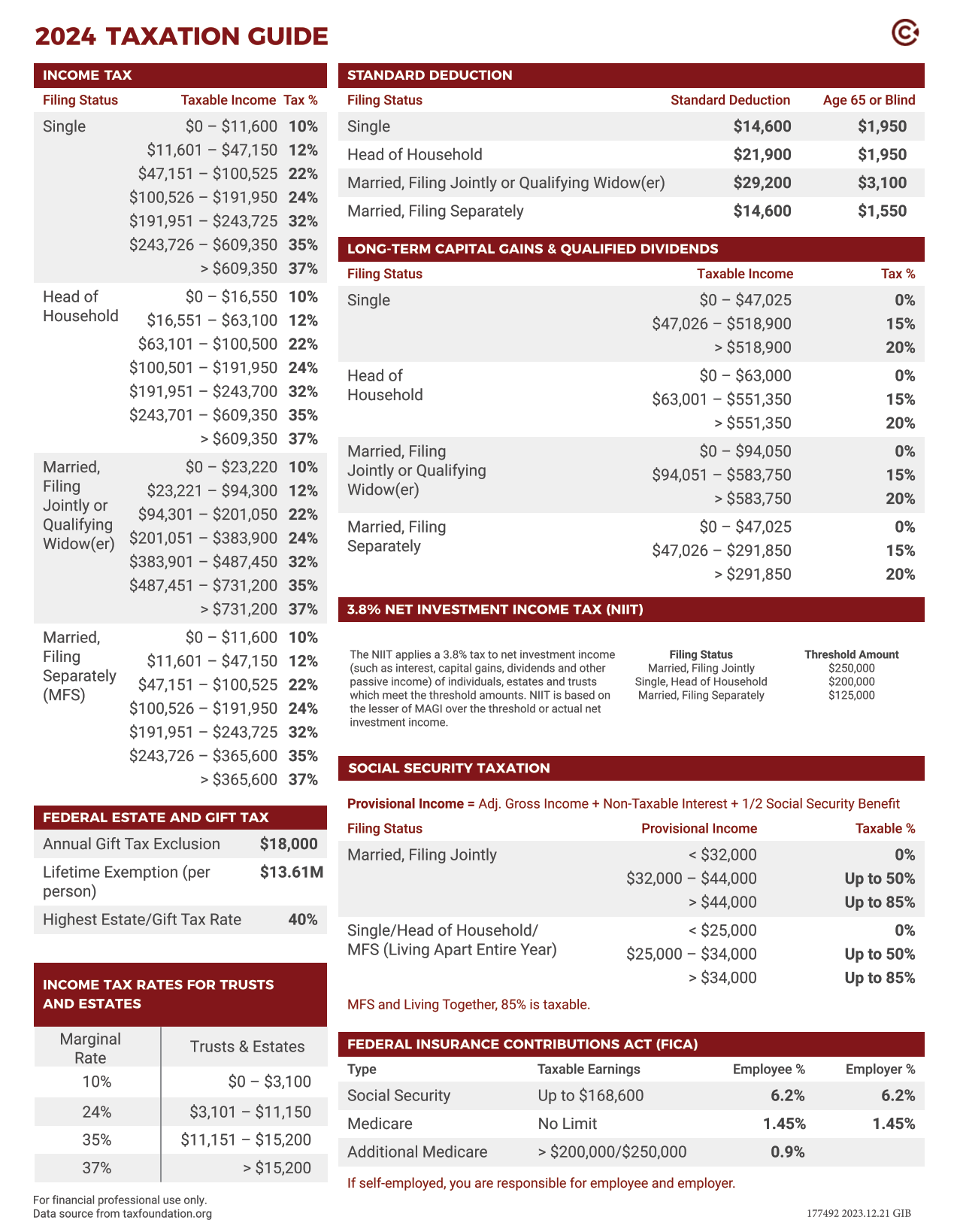

2024 Tax Guide

Get a copy of the 2024 Tax Guide below.

Tax Brackets

Deductions

Income Ranges for IRA Contributions

Cares Act Charitable Deduction

Estate Tax Exclusions

Ready to see if fixed indexed annuities could help your clients reach their retirement goals?

Tools for Financial Professionals

Benefits of Fixed Indexed Annuities

Retirement Questions

There is no magic number for retirement, but many baby boomers don’t know where to start.

Retirement Challenges

Americans are facing retirement planning challenges. Fixed indexed annuities can help increase financial security.

Retirement & Annuities

Louise Bridges talks about why indexed annuities work for her.

Indexed Annuity Basics

Take the confusion out of understanding annuities and how they fit into a retirement plan.

Lifetime Income

A guaranteed lifetime withdrawal benefit can help people secure predictable income for life.

Sort FIA Facts from FIA Fiction

Calculating goals, reevaluating strategies, and adjusting contributions are just as essential as lifestyle changes before and during retirement.

News

Events

Education

Advocacy

Membership

Contact

NAFA encourages states to evolve annuity suitability

Annuity Crediting Strategies: Cap Strategy

For 25 years, fixed indexed annuities (FIA) have been helping consumers enjoy downside protection and upside potential in their retirement plans. Yet these products, and indexing in particular, are still widely misunderstood and even misrepresented by some entities.

NAFA’s newest educational series seeks to break down specific features and benefits of these annuities in a way that anyone — regulator, legislator, journalist, agent or consumer — can understand. First, let’s take a look at how the point-to-point cap strategy works and why it’s a popular option available on many FIAs.

20 Reasons to be a NAFA Member

By becoming a Premier or Affiliate Partner of the only association dedicated exclusively to fixed annuities and their independent distribution, you can ensure that, together, we have a strong presence and positive, proactive impact on every aspect of our evolving industry.

As an annuity leader, it’s critical that your organization is aware of and involved in the key issues affecting the future of our business. At NAFA, the National Association of Fixed Annuities, we make that possible … and we make it easy.

Delivering the Data You Need!

Your Financial Stability is their Priority.

You need a company that can provide specific solutions to help you feel confident about your financial goals.

For over 100 years, North American® has helped people secure their future and protect their loved ones.

When it comes to developing an overall retirement strategy, knowledge really is power. The resources here can help clarify your own needs and goals – and give you insight into the latest research.

Retirement Income Calculator

How much money will you need to save over time to generate your desired income in retirement?

Tools

Benefit of Tax Deferral Calculator

Why consider a tax-deferred investment?

Tools

“At American Equity, it’s not the building, it’s not the charter—

it’s the people who make the company.”

– David J. Noble, Founder

Power of Protection

Three historic bear market examples demonstrating the time it takes to recover loss.

The Basics: Annuities

Learn the basics of how annuities work and where they fit into your path to retirement.

The Basics: FIAs

Get information about how fixed index annuities work and how they can play a role in retirement income planning.

The Basics: LIBR

Find out more about lifetime income benefit riders and how they work when preparing for life in retirement.

American Equity is a retirement income provider specializing in fixed index annuities that are designed to protect principal and guarantee income. We’re an American-owned and operated company, headquartered in the Midwest, where we help fund more than half a million retirements nationwide.

American Equity’s annuities are designed to help plan for a retirement you want. We help our contract owners protect and preserve their assets for a financially sound future. Our contract owners can sleep at night knowing their retirement dollars are preserved and that their long-term income is secure. Here at American Equity, we like to call this “Sleep Insurance®.”